What Kind of Grant Is Temporary Assistance for Needy Families

Official seal | |

HHS Logo | |

| Program overview | |

|---|---|

| Preceding Program |

|

| Jurisdiction | Federal authorities of the United States |

| Annual budget | $17.35 billion (FY2014)[1] |

| Website | TANF |

Temporary Help for Needy Families (TANF ) is a federal aid programme of the United States. It began on July 1, 1997, and succeeded the Assistance to Families with Dependent Children (AFDC) plan, providing greenbacks aid to indigent American families through the United States Department of Health and Human being Services.[ii] TANF is often only referred to equally welfare.

The TANF programme, emphasizing the welfare-to-piece of work principle, is a grant given to each land to run its ain welfare program and designed to exist temporary in nature and has several limits and requirements. The TANF grant has a maximum benefit of two consecutive years and a five-yr lifetime limit and requires that all recipients of welfare aid must find work within two years of receiving aid, including single parents who are required to work at least 30 hours per week opposed to 35 or 55 required by two parent families. Failure to comply with work requirements could result in loss of benefits. TANF funds may be used for the following reasons: to provide assistance to needy families so that children can be cared for at home; to stop the dependence of needy parents on government benefits by promoting job preparation, work and marriage; to prevent and reduce the incidence of out-of-wedlock pregnancies; and to encourage the formation and maintenance of two-parent families.

Groundwork [edit]

Prior to TANF, Aid to Families with Dependent Children was a major federal assistance program that was coming under heavy criticism. Some argued that such programs were ineffective, promoted dependency on the authorities, and encouraged behaviors detrimental to escaping from poverty.[iii] Some people too argued that TANF is detrimental to its recipients because using these programs have a stigma attached to them, which makes the people that use them less likely to participate politically to defend this programme, and thus the programs have been afterwards weakened. Start with President Ronald Reagan's administration and continuing through the first few years of the Clinton administration, growing dissatisfaction with AFDC, particularly the rise in welfare caseloads, led an increasing number of states to seek waivers from AFDC rules to permit states to more than stringently enforce work requirements for welfare recipients. The 27 percent increment in caseloads between 1990 and 1994 accelerated the push by states to implement more radical welfare reform.[4]

States that were granted waivers from AFDC plan rules to run mandatory welfare-to-work programs were also required to rigorously evaluate the success of their programs. Equally a effect, many types of mandatory welfare-to-work programs were evaluated in the early 1990s. While reviews of such programs found that nigh all programs led to significant increases in employment and reductions in welfare rolls, there was fiddling evidence that income amid old welfare recipients had increased. In effect, increases in earnings from jobs were offset by losses in public income, leading many to conclude that these programs had no anti-poverty furnishings.[5] However, the findings that welfare-to-work programs did have some effect in reducing dependence on government increased back up among policymakers for moving welfare recipients into employment.[6]

While liberals and conservatives agreed on the importance of transitioning families from government assistance to jobs, they disagreed on how to accomplish this goal. Liberals idea that welfare reform should aggrandize opportunities for welfare mothers to receive training and work experience that would assistance them raise their families' living standards by working more and at higher wages.[6] Conservatives emphasized work requirements and fourth dimension limits, paying little attention to whether or non families' incomes increased. More specifically, conservatives wanted to impose a five-twelvemonth lifetime limit on welfare benefits and provide cake grants for states to fund programs for poor families.[7] Conservatives argued that welfare to work reform would be beneficial by creating function models out of mothers, promoting maternal self-esteem and sense of control, and introducing productive daily routines into family life. Furthermore, they argued that reforms would eliminate welfare dependence by sending a powerful message to teens and immature women to postpone childbearing. Liberals responded that the reform sought by conservatives would overwhelm severely stressed parents, deepen the poverty of many families, and force immature children into unsafe and unstimulating kid care situations. In add-on, they asserted that welfare reform would reduce parents' power to monitor the behaviors of their children, leading to issues in child and adolescent performance.[8]

In 1992, as a presidential candidate, Bill Clinton pledged to "finish welfare as nosotros know it" by requiring families receiving welfare to work after two years. As president, Clinton was attracted to welfare expert and Harvard University Professor David Ellwood's proposal on welfare reform and thus Clinton eventually appointed Ellwood to co-chair his welfare task strength. Ellwood supported converting welfare into a transitional system. He advocated providing assist to families for a limited fourth dimension, afterward which recipients would exist required to earn wages from a regular job or a work opportunity plan.[vi] Low wages would be supplemented by expanded tax credits, admission to subsidized childcare and health insurance, and guaranteed child back up.

In 1994, Clinton introduced a welfare reform proposal that would provide job preparation coupled with time limits and subsidized jobs for those having difficulty finding work, but it was defeated.[vii] Later that year, when Republicans attained a Congressional majority in Nov 1994, the focus shifted toward the Republican proposal to end entitlements to assistance, repeal AFDC and instead provide states with blocks grants.[9] The debates in Congress almost welfare reform centered around five themes:[9]

- Reforming Welfare to Promote Work and Fourth dimension Limits: The welfare reform discussions were dominated by the perception that the then-existing greenbacks assistance plan, AFDC, did not practise enough to encourage and require employment, and instead incentivized non-piece of work. Supporters of welfare reform also argued that AFDC fostered divorce and out-of-wedlock nativity, and created a culture of dependency on government assistance. Both President Clinton and Congressional Republicans emphasized the need to transform the greenbacks assistance system into a work-focused, time-limited program.

- Reducing Projected Spending: Republicans argued that projected federal spending for depression-income families was too high and needed to be reduced to lower overall federal spending.

- Promoting Parental Responsibility: At that place was wide agreement among politicians that both parents should support their children. For custodial parents, this meant an emphasis on work and cooperation with child support enforcement. For non-custodial parents, it meant a set of initiatives to strengthen the effectiveness of the child support enforcement.

- Addressing Out-of-Spousal relationship Birth: Republicans argued that out of wedlock nativity was presenting an increasingly serious social problem and that the federal government should piece of work to reduce out-of-wedlock births.

- Promoting Devolution: A mutual theme in the debates was that the federal authorities had failed and that states were more successful in providing for the needy, and thus reform needed to provide more than power and authority to states to shape such policy.

Clinton twice vetoed the welfare reform bill put forward past Newt Gingrich and Bob Dole. Then only before the Autonomous Convention he signed a third version subsequently the Senate voted 74–24[ten] and the House voted 256–170[xi] in favor of welfare reform legislation, formally known equally the Personal Responsibility and Work Opportunity Reconciliation Human activity of 1996 (PRWORA). Clinton signed the bill into law on August 22, 1996. PRWORA replaced AFDC with TANF and dramatically changed the manner the federal government and states determine eligibility and provide aid for needy families.

Before 1997, the federal government designed the overall program requirements and guidelines, while states administered the program and determined eligibility for benefits. Since 1997, states have been given block grants and both blueprint and administer their own programs. Admission to welfare and amount of help varied quite a chip by state and locality under AFDC, both because of the differences in state standards of need and considerable subjectivity in caseworker evaluation of qualifying "suitable homes".[12] Nonetheless, welfare recipients under TANF are actually in completely different programs depending on their state of residence, with different social services available to them and different requirements for maintaining aid.[13]

Country implementations [edit]

States have large amounts of latitude in how they implement TANF programs.[14] [15] [16] [17]

- Alabama: The Family Help Programme

- Alaska: The Alaska Temporary Aid Program

- Arizona: Cash Assist

- Arkansas: Arkansas TANF

- California: CalWORKs

- Colorado: Colorado Works Program

- Connecticut: Connecticut TANF

- Delaware: Delaware TANF

- Florida: Temporary Cash Assistance

- Georgia: Georgia TANF

- Hawaii: Hawaii TANF

- Idaho: Temporary Help for Families in Idaho

- Illinois: Illinois TANF

- Indiana: Indiana TANF

- Iowa: Family unit Investment Program

- Kansas: Successful Families Program

- Kentucky: Kentucky Transitional Help Programme

- Louisiana: Family unit Independence Temporary Assistance

- Maine: Maine TANF

- Maryland: Temporary Cash Assistance

- Massachusetts: Massachusetts TANF

- Michigan:Cash Assistance

- Minnesota: Minnesota TANF

- Mississippi: Mississippi TANF

- Missouri: Temporary Help

- Montana: Montana TANF

- Nebraska: Aid to Dependent Children

- Nevada: Nevada TANF

- New Hampshire: The Financial Assist to Needy Families Plan

- New Jersey: WorkFirstNJ

- New Mexico: NMWorks

- New York: Temporary Aid

- Northward Carolina: Work First Cash Assistance

- North Dakota: North Dakota TANF

- Ohio: Ohio Work First

- Oklahoma: Oklahoma TANF

- Oregon: Oregon TANF

- Pennsylvania: Pennsylvania TANF

- Rhode Island: RI Works

- South Carolina: TANF/Formerly Family unit Independence

- South Dakota: Southward Dakota TANF

- Tennessee: Families First

- Texas: Texas TANF

- Utah: Utah TANF

- Vermont: Vermont TANF Programs

- Virginia: Virginia TANF

- Washington: Washington TANF

- Due west Virginia: Family unit Assistance

- Wisconsin: Wisconsin Works

- Wyoming: POWER Works

Funding and eligibility [edit]

Evolution of monthly AFDC and TANF benefits in the USA (in 2006 dollars)[18]

PRWORA replaced AFDC with TANF and concluded entitlement to cash assistance for low-income families, pregnant that some families may be denied assistance even if they are eligible. Nether TANF, states have broad discretion to determine who is eligible for benefits and services. In general, states must employ funds to serve families with children, with the simply exceptions related to efforts to reduce not-marital childbearing and promote spousal relationship. States cannot apply TANF funds to aid almost legal immigrants until they take been in the country for at least five years. TANF sets forth the following work requirements in order to qualify for benefits:[19]

- Recipients (with few exceptions) must work as shortly as they are chore ready or no later than two years after coming on assistance.

- Single parents are required to participate in work activities for at least 30 hours per week. Ii-parent families must participate in piece of work activities 35 or 55 hours a week, depending upon circumstance.

- Failure to participate in work requirements tin result in a reduction or termination of benefits to the family.

- States, in fiscal year 2004, have to ensure that 50 percent of all families and 90 percentage of two-parent families are participating in work activities. If a state meets these goals without restricting eligibility, information technology tin receive a caseload reduction credit. This credit reduces the minimum participation rates the state must achieve to go on receiving federal funding.

While states are given more flexibility in the design and implementation of public assistance, they must do so within various provisions of the law:[20]

- Provide assistance to needy families so that children may be cared for in their own homes or in the homes of relatives;

- finish the dependence of needy parents on authorities benefits by promoting task preparation, work, and marriage;

- prevent and reduce the incidence of out-of-wedlock pregnancies and establish annual numerical goals for preventing and reducing the incidence of these pregnancies;

- and encourage the formation and maintenance of two-parent families.

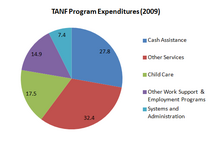

TANF Program Spending[xix]

Since these iv goals are deeply general, "states tin can employ TANF funds much more broadly than the cadre welfare reform areas of providing a rubber net and connecting families to work; some states use a substantial share of funding for these other services and program".[21]

Funding for TANF underwent several changes from its predecessor, AFDC. Nether AFDC, states provided cash assistance to families with children, and the federal authorities paid half or more than of all program costs.[9] Federal spending was provided to states on an open up-concluded basis, meaning that funding was tied to the number of caseloads. Federal law mandated that states provide some level of cash assistance to eligible poor families but states had broad discretion in setting the benefit levels. Under TANF, states qualify for block grants. The funding for these cake grants accept been fixed since fiscal twelvemonth 2002 and the corporeality each state receives is based on the level of federal contributions to the state for the AFDC program in 1994, with no adjustments for aggrandizement, size of caseload, or other factors.[22] [23] : four This has led to a great disparity in the grant size per child living in poverty amid usa, ranging from a low of $318 per child in poverty in Texas to a high of $3,220 per child in poverty in Vermont, with the median per child grant size existence $1,064 in Wyoming.[23] : Effigy i The states are required to maintain their spending for welfare programs at fourscore percent of their 1994 spending levels, with a reduction to 75 percent if states meet other piece of work-participation requirements. States have greater flexibility in deciding how they spend funds as long as they meet the provisions of TANF described in a higher place.

Currently, states spend only slightly more than one-quarter of their combined federal TANF funds and the state funds they must spend to meet TANF'south "maintenance of effort" (MOE) requirement on basic help to encounter the essential needs of families with children, and but another quarter on kid intendance for low-income families and on activities to connect TANF families to work. They spend the rest of the funding on other types of services, including programs not aimed at improving employment opportunities for poor families. TANF does not require states to report on whom they serve with the federal or state funds they shift from cash assistance to other uses.[24]

In July 2012, the Section of Health and Human Services released a memo notifying states that they are able to utilise for a waiver for the work requirements of the TANF programme. Critics claim the waiver would allow states to provide assist without having to enforce the work component of the program.[25] The administration has stipulated that any waivers that weaken the work requirement will be rejected.[26] The DHHS granted the waivers afterwards several Governors requested more state control.[27] The DHHS agreed to the waivers on the stipulation that they continue to see all Federal requirements.[28] States were given the right to submit their own plans and reporting methods merely if they continued to meet Federal requirements and if the country programs proved to exist more effective.

Impact [edit]

Case load [edit]

Between 1996 and 2000, the number of welfare recipients plunged past 6.5 million, or 53% nationally. The number of caseloads was lower in 2000 than at any time since 1969, and the percentages of persons receiving public help income (less than 3%) was the everyman on record.[29] Since the implementation of TANF occurred during a menstruation of strong economic growth, there are questions almost how much of the reject in caseloads is owing to TANF program requirements. Start, the number of caseloads began failing subsequently 1994, the twelvemonth with the highest number of caseloads, well earlier the enactment of TANF, suggesting that TANF was not solely responsible for the caseload decline.[4] Research suggests that both changes in welfare policy and economic growth played a substantial role in this decline, and that no larger than one-third of the decline in caseloads is attributable to TANF.[29] [30] [ needs update ]

Work, earnings, and poverty [edit]

One of the major goals of TANF was to increase work among welfare recipients. During the post-welfare reform period, employment did increase among unmarried mothers. Unmarried mothers with children showed niggling changes in their labor force participation rates throughout the 1980s and into the mid-1990s, merely between 1994–1999, their labor forcefulness participation rose by 10%.[four] Amidst welfare recipients, the percent that reported earnings from employment increased from half-dozen.7% in 1990 to 28.1% past 1999.[four] While employment of TANF recipients increased in the early on years of reform, information technology declined in the later on period subsequently reform, especially after 2000. From 2000–2005, employment among TANF recipients declined by six.5%.[31] Among welfare leavers, it was estimated that shut to two-thirds worked at a future betoken in time[32] [33] About twenty percentage of welfare leavers are not working, without a spouse, and without any public aid.[31] Those who left welfare because of sanctions (fourth dimension limits or failure to meet plan requirements) fared comparably worse than those who left welfare voluntarily. Sanctioned welfare recipients have employment rates that are, on average, 20 percent below those who left for reasons other than sanctions.[34]

While the participation of many depression-income single parents in the labor market has increased, their earnings and wages remained low, and their employment was concentrated in depression-wage occupations and industries. 78 pct of employed low-income single parents were full-bodied in 4 typically low-wage occupations: service; administrative back up and clerical; operators, fabricators, and laborers; and sales and related jobs.[35] While the average income among TANF recipients increased over the early years of reform, it has become stagnant in the after period; for welfare leavers, their boilerplate income remained steady or declined in the later years.[31] Studies that compared household income (includes welfare benefits) before and after leaving welfare observe that between one-tertiary and one-half of welfare leavers had decreased income after leaving welfare.[30] [36]

During the 1990s, poverty amid unmarried-mother and their families declined chop-chop from 35.4% in 1992 to 24.7% in 2000, a new historic low.[4] However, due to the fact that low-income mothers who left welfare are likely to be full-bodied in low-wage occupations, the decline in public assist caseloads has not translated easily into reduction in poverty. The number of poor female person-headed families with children dropped from 3.eight million to 3.1 million between 1994 and 1999, a 22% decline compared to a 48% decline in caseloads.[29] As a upshot, the share of working poor in the U.Southward. population rose, as some women left public assistance for employment simply remained poor.[4] Near studies have found that poverty is quite loftier amongst welfare leavers. Depending on the source of the data, estimates of poverty among leavers vary from nearly 48% to 74%.[32] [37]

TANF requirements have led to massive drops in the number of people receiving cash benefits since 1996,[38] only there has been footling alter in the national poverty rate during this fourth dimension.[39] The table below shows these figures forth with the annual unemployment charge per unit.[twoscore] [41] [42]

| Year | Average monthly TANF recipients | Poverty rate (%) | Annual unemployment rate (%) |

|---|---|---|---|

| 1996 | 12,320,970 (see note) | 11.0 | 5.4 |

| 1997 | ten,375,993 | 10.three | 4.9 |

| 1998 | eight,347,136 | x.0 | four.v |

| 1999 | 6,824,347 | nine.3 | 4.2 |

| 2000 | 5,778,034 | 8.7 | 4.0 |

| 2001 | 5,359,180 | ix.two | 4.seven |

| 2002 | 5,069,010 | 9.6 | 5.8 |

| 2003 | iv,928,878 | 10.0 | half dozen.0 |

| 2004 | 4,748,115 | x.ii | 5.5 |

| 2005 | 4,471,393 | 9.nine | v.1 |

| 2006 | four,166,659 | ix.viii | 4.6 |

| 2007 | 3,895,407 | 9.8 | 4.v |

| 2008 | three,795,007 | 10.3 | 5.four |

| 2009 | 4,154,366 | 11.1 | 8.1 |

| 2010 | four,375,022 | 11.7 | 8.six |

Note: 1996 was the final year for the AFDC program, and is shown for comparison. All figures are for agenda years. The poverty rate for families differs from the official poverty rate.

Wedlock and fertility [edit]

A major impetus for welfare reform was concern most increases in out-of-wedlock births and failing marriage rates, especially among depression-income women. The major goals of the 1996 legislation included reducing out-of-wedlock births and increasing rates and stability of marriages.[4]

Studies accept produced simply modest or inconsistent evidence that marital and cohabitation decisions are influenced by welfare program policies. Schoeni and Bare (2003) constitute that pre-1996 welfare waivers were associated with modest increases in probabilities of marriage.[43] Even so, a similar analysis of mail service-TANF event revealed less consistent results. Nationally, merely 0.4% of airtight cases gave union every bit the reason for leaving welfare.[29] Using data on spousal relationship and divorces from 1989–2000 to examine the role of welfare reform on spousal relationship and divorce, Bitler (2004) found that both state waivers and TANF program requirements were associated with reductions in transitions into marriage and reductions from union to divorce.[44] In other words, individuals who were non married were more likely to stay single, and those who were married were more than likely to stay married. Her caption behind this, which is consistent with other studies, is that after reform unmarried women were required to work more, increasing their income and reducing their incentive to requite up independence for marriage, whereas for married women, post-reform there was potentially a significant increment in the number of hours they would accept to work when single, discouraging divorce.[45] [46]

In addition to union and divorce, welfare reform was likewise concerned about unwed childbearing. Specific provisions in TANF were aimed at reducing unwed childbearing. For example, TANF provided greenbacks bonuses to states with the largest reductions in unwed childbearing that are not accompanied by more than abortions. States were also required to eliminate greenbacks benefits to unwed teens under historic period eighteen who did not reside with their parents. TANF allowed states to impose family caps on the receipt of boosted cash benefits from unwed childbearing. Between 1994 and 1999, unwed childbearing among teenagers declined 20 percent among fifteen- to 17-yr-olds and 10 percent amid 18- and nineteen-year-olds.[29] In a comprehensive cantankerous-state comparison, Horvath-Rose & Peters (2002) studied nonmarital birth ratios with and without family cap waivers over the 1986–1996 period, and they establish that family caps reduced nonmarital ratios.[47] Whatever fears that family caps would lead to more abortions was allayed by declining numbers and rates of ballgame during this period.[48]

Child well-being [edit]

Proponents of welfare reform argued that encouraging maternal employment will enhance children's cognitive and emotional development. A working female parent, proponents assert, provides a positive function model for her children. Opponents, on the other hand, argued that requiring women to work at low pay puts additional stress on mothers, reduces the quality time spent with children, and diverts income to piece of work-related expenses such as transportation and childcare.[29] Testify is mixed on the impact of TANF on child welfare. Duncan & Hunt-Lansdale (2001) found that the bear upon of welfare reform varied by age of the children, with more often than not positive effects on school achievement among elementary-school age children and negative effects on adolescents, especially with regards to risky or problematic behaviors.[49] Some other written report found large and significant effects of welfare reform on educational achievement and aspirations, and on social behavior (i.e. instructor assessment of compliance and self-command, competence and sensitivity). The positive effects were largely due to the quality of childcare organization and afterschool programs that accompanied the move from welfare to work for these recipients.[50] Yet another report found that substitution from maternal intendance to other informal care had caused a significant drop in functioning of immature children.[51] In a program with less generous benefits, Kalili et al. (2002) found that maternal work (measured in months and hours per week) had little overall effect on children's antisocial beliefs, anxious/depressed behavior or positive behavior. They find no show that children were harmed past such transitions; if anything, their mothers report that their children are better behaved and have better mental health.[52]

Synthesizing findings from an extensive selection of publications, Aureate (2005) reached the decision that children'due south outcomes were largely unchanged when examining children's developmental gamble, including health status, beliefs or emotional issues, suspensions from school, and lack of participation in extracurricular activities.[53] She argues that contrary to the fears of many, welfare reform and an increment in parental work did not seem to have reduced children's well-existence overall. More abused and neglected children had not entered the child welfare system. However, at the aforementioned time, improvement in parental earnings and reductions in child poverty had not consistently improved outcomes for children.

Maternal well-beingness [edit]

While the material and economical well-being of welfare mothers after the enactment of TANF has been the subject of countless studies, their mental and physical well-being has received little attention. Enquiry on the latter has found that welfare recipients confront mental and physical problems at rates that are higher than the general population.[54] Such problems which include depression, anxiety disorder, mail-traumatic stress disorder, and domestic violence mean that welfare recipients face many more barriers to employment and are more at risk of welfare sanctions due to noncompliance with work requirements and other TANF regulations[29] Enquiry on the health status of welfare leavers have indicated positive results. Findings from the Women's Employment Report, a longitudinal survey of welfare recipients in Michigan, indicated that women on welfare only non working are more probable to take mental health and other issues than are former welfare recipients now working.[54] [55] Similarly, interviews with now employed welfare recipients find that partly as a effect of their increased material resources from working, the women felt that work has led to higher cocky-esteem, new opportunities to expand their social support networks, and increased feelings of self-efficacy.[56] Furthermore, they became less socially isolated and potentially less prone to low. At the same time, however, many women were experiencing stress and exhaustion from trying to balance work and family responsibilities.

Paternal well-being [edit]

For unmarried fathers within the programme, there is a small percentage increment of employment in comparison to unmarried mothers, but there is a meaning increase of increased wages throughout their fourth dimension in the program.[57] As of June 2020, the number of one-parent families participating in TANF is 432,644.[58]

[edit]

Enacted in July 1997, TANF was prepare for reauthorization in Congress in 2002. However, Congress was unable to reach an agreement for the next several years, and as a result, several extensions were granted to go along funding the program. TANF was finally reauthorized nether the Deficit Reduction ACT (DRA) of 2005. DRA included several changes to the original TANF plan. It raised work participation rates, increased the share of welfare recipients field of study to work requirements, express the activities that could be counted as work, prescribed hours that could exist spent doing certain work activities, and required states to verify activities for each developed beneficiary.[59]

In February 2009, every bit part of the American Recovery and Reinvestment Act of 2009 (ARRA), Congress created a new TANF Emergency Fund (TANF EF), funded at $five billion and bachelor to states, territories, and tribes for federal fiscal years 2009 and 2010. The original TANF law provided for a Contingency Fund (CF) funded at $ii billion which allows states coming together economic triggers to depict additional funds based upon high levels of state MOE spending. This fund was expected to (and did) run out in FY 2010. The TANF Emergency Fund provided states fourscore percent of the funding for spending increases in three categories of TANF-related expenditures in FYs 2009 or 2010 over FYs 2007 or 2008. The 3 categories of expenditures that could be claimed were bones help, non-recurrent brusk-term benefits, and subsidized employment.[sixty] The 3rd category listed, subsidized employment, made national headlines[61] every bit states created near 250,000 adult and youth jobs through the funding.[62] The program all the same expired on September 30, 2010, on schedule with states cartoon downward the entire $5 billion allocated by ARRA.[63]

TANF was scheduled for reauthorization again in 2010. All the same, Congress did not piece of work on legislation to reauthorize the plan and instead they extended the TANF cake grant through September 30, 2011, as part of the Claims Resolution Act.[64] During this period Congress again did not reauthorize the plan but passed a iii-calendar month extension through December 31, 2011.[ needs update ]

Exiting The TANF Plan [edit]

When transitioning out of the TANF program, individuals find themselves in one of three situations that establish the reasons for exiting:[65]

- The first situation involves work related TANF exit, in which individuals no longer qualify for TANF help due to acquired employment.

- The second blazon of state of affairs is non- work TANF related exit in which the recipient no longer qualifies for assistance due to reaching the maximum time allowed to be enrolled in the assistance plan. One time their time limit has been reached, individuals are removed from receiving aid.

- The 3rd type of state of affairs is connected TANF receipt in which employed recipients earning a wage that does not assist comprehend expenses continue receiving assistance.

Information technology has been observed that sure situations of TANF exit are more prominent depending on the geographic area which recipients alive in. Focusing the comparison between metropolitan (urban) areas and non-metropolitan (rural) areas, the number of recipients experiencing non piece of work TANF related leave is highest amidst rural areas (rural areas in the S feel the highest cases of this type of exiting the program).[65]

Information disproportion or lack of knowledge amid recipients on the diverse TANF work incentive programs is a contributor to recipients experiencing non work related TANF exits. Not beingness aware of the offered programs impacts their utilize and creates misconceptions that influence the responsiveness of those who qualify for such programs, resulting in longer time periods requiring TANF services.[66] Recipients who exit TANF due to work are likewise afflicted past information asymmetry due to lack of awareness on the "transitional support" programs available to facilitate their transitioning into the work field. Programs such as childcare, food stamps, and Medicaid are meant increment piece of work incentive only many TANF recipients transitioning into piece of work do non know they are eligible.[67] It has been shown that TANF-exiting working women who utilise and maintain the transitional incentive services described above are less probable to render to receiving assistance and are more likely to experience long term employment.[68]

Criticism [edit]

Peter Edelman, an banana secretary in the Department of Health and Human being Services, resigned from the Clinton administration in protest of Clinton signing the Personal Responsibleness and Work Opportunity Act, which he chosen, "The worst thing Pecker Clinton has done."[69] According to Edelman, the 1996 welfare reform law destroyed the rubber net. It increased poverty, lowered income for single mothers, put people from welfare into homeless shelters, and left states gratuitous to eliminate welfare entirely. It moved mothers and children from welfare to work, simply many of them aren't making enough to survive. Many of them were pushed off welfare rolls considering they didn't show up for an appointment, when they had no transportation to become to the appointment, or weren't informed about the appointment, said Edelman.[seventy] [71]

Critics later said that TANF was successful during the Clinton Administration when the economy was booming, only failed to support the poor when jobs were no longer available during the downturn, particularly the Financial crisis of 2007–2010, and particularly after the lifetime limits imposed by TANF may have been reached by many recipients.[72]

References [edit]

- ^ U.Southward Section of Wellness and Human Services. 2012. "TANF FY 2014 Upkeep." Accessed 12/2/2014 from https://world wide web.acf.hhs.gov/sites/default/files/olab/sec3i_tanf_2014cj.pdf

- ^ U.Due south. Section of Health and Human Services. 2011. "TANF". Accessed 12/9/2011 from "Archived copy". Archived from the original on March 14, 2012. Retrieved March 19, 2011.

{{cite web}}: CS1 maint: archived copy every bit title (link) - ^ Mead, Lawrence M. (1986). Across Entitlement: The Social Obligations of Citizenship. New York: Gratis Press. ISBN978-0-02-920890-8.

- ^ a b c d due east f g Bare, Rebecca. 2002. "Evaluating Welfare Reform in the United States." Journal of Economic Literature, American Economic Clan 40(4): 1105–116

- ^ Blossom, Dan and Charles Michalopoulos. 2001. How Welfare and Work Policies Affect Employment and Income: A Synthesis of Enquiry. New York: Manpower Demonstration Research Corporation

- ^ a b c Danziger, Sheldon (December 1999). "Welfare Reform Policy from Nixon to Clinton: What Role for Social Science?" (PDF). Gerald R. Ford School of Public Policy. Retrieved December 11, 2011. Paper prepared for Conference, "The Social Scientific discipline and Policy Making". Establish for Social Inquiry, University of Michigan, March 13–14, 1998

- ^ a b Plant for Policy Enquiry (2008). "A Await Back at Welfare Reform" (PDF). 30 (1). Northwestern Academy. Retrieved Oct 11, 2011. ;

- ^ Duncan, Greg J. and P. Lindsay Chase-Lansdale. 2001. "For Better and for Worse: Welfare Reform and the Well-beingness of Children Families." In For Better and for Worse: Welfare Reform and the Well-being of children and Families. New York: Russell Sage Foundation

- ^ a b c Greenberg, Marker et al. 2000. Welfare Reauthorization: An Early on Guide to the Issues. Heart for Law and Social Policy

- ^ "U.S. Senate: Roll Phone call Vote". senate.gov.

- ^ "Archived copy". clerk.house.gov. Archived from the original on October 25, 2006. Retrieved January 13, 2022.

{{cite spider web}}: CS1 maint: archived copy as title (link) - ^ Lieberman, Robert (2001). Shifting the Colour Line: Race and the American Welfare State . Boston: Harvard University Printing. ISBN978-0-674-00711-half dozen.

- ^ Kaufman, Darren S. "Aid to Families with Dependent Children (ADFC)", in Encyclopedia of Health Intendance Management, ed. Michael J. Stahl. SAGE Publications, 2003, p. 17

- ^ Rowe, Gretchen (2000), "Country TANF Policies as of July 1999" (PDF), Welfare Rules Database

- ^ Melt, E.A. (1962). "Ideal and Real: The Acculturation Continuum". American Anthropologist. 64 (i): 163–165. doi:10.1525/aa.1962.64.i.02a00150. JSTOR 666735.

- ^ Mazzeo, Christopher; Rab, Sara; Eachus, Susan (2003). "Work-First or Work-Only: Welfare Reform, Land Policy, and Access to Postsecondary Education". Annals of the American University of Political and Social Scientific discipline. 586: 144–171. doi:10.1177/0095399702250212. JSTOR 1049724. S2CID 154484859.

- ^ Soss, Joe; Fording, Richard C.; Schram, Sanford F. (2008). "The Color of Devolution: Race, Federalism, and the Politics of Social Command". American Journal of Political Scientific discipline. 52 (3): 536–553. doi:x.1111/j.1540-5907.2008.00328.x. JSTOR 25193832.

- ^ 2008 Indicators of Welfare Dependence Effigy TANF 2.

- ^ a b Schott, Liz. 2011. Policy Basics: An Introduction to TANF. Center on Budget and Policy Priorities. Accessed 11/2/2011 from http://www.cbpp.org/cms/index.cfm?fa=view&id=936

- ^ U.S. Department of Health and Human Services. About TANF.U.S. Section of Health and Homo Services. Accessed 11/ii/2011 from "Archived re-create". Archived from the original on March fourteen, 2012. Retrieved March 19, 2011.

{{cite web}}: CS1 maint: archived copy every bit title (link) - ^ "Policy Basics: An Introduction to TANF". Center on Budget and Policy Priorities. November 17, 2008. Retrieved May 15, 2017.

- ^ Loprest, Pamela, Stefanie Schmidt, and Anne Dryden White. 2000. "Welfare Reform under PRWORA: Aid to Children with Working Families?" in Tax Policy and the Economy edited by James M. Poterba: 157–203

- ^ a b Falk, Gene; Carter, Jameson A.; Ghavalyan, Mariam (October 9, 2019). The Temporary Assistance for Needy Families Block Grant: Legislative Problems in the 116th Congress (Study). Congressional Research Service. Retrieved Oct 23, 2019.

- ^ Schott, Liz. "How States Use Federal and Land Funds Under the TANF Block Grant". The Center on Budget Policy and Priorities.

- ^ "Republicans accuse HHS of gutting welfare reform with repose policy change". FoxNews.com. July 13, 2012. Retrieved July 19, 2012.

- ^ "Romney's starting his race to the bottom". suntimes.com. Baronial 8, 2012. Retrieved Baronial 8, 2012.

- ^ "three Reasons Why Republican Governors Asked to Reform Their Welfare Programs – Center for American Progress Action Fund". americanprogressaction.org. September 6, 2012.

- ^ [1] [ dead link ]

- ^ a b c d e f thou Lichter, Daniel T. and Rukamalie Jayakody. 2002. "Welfare Reform: How Do Nosotros Measure Success?" Annual Review of Sociology 28:117–141

- ^ a b Bavier, Richard. 2001. "Welfare Reform Data from the Survey of Income and Program Participation." Monthly Labor Review (July): thirteen–24

- ^ a b c Acs, Gregory and Pamela Loprest. 2007. "TANF Caseload Composition and Leavers Synthesis Report". The Urban Institute

- ^ a b Moffitt, Robert A. and Jennifer Roff. 2000. "The Multifariousness of Welfare Leavers, Welfare Children, and Families: A Three Metropolis Study." Johns Hopkins University Policy Brief 00-02

- ^ Devere, Christine. 2001. "Welfare Reform Research: What Do We Know About Those Who Leave Welfare?" CRS Report for Congress. Washington, D.C.: Congressional Research service

- ^ Tweedie, Jack. 2001. "Sanctions and Exists: What States Know about Families that leave Welfare Considering of Sanctions and Fourth dimension Limits." In For Improve and for Worse: Welfare Reform and the Well-existence of Children Families. New York: Russell Sage Foundation

- ^ Peterson, Janice et al. 2002. Life After Welfare Reform: Low-income Single Parent Families, Pre- and Post-TANF. Institute for Women's Policy Enquiry #D446

- ^ Cancian, Maria. 2000. Before and After TANF: The Economical Well-Being of Women Leaving Welfare. Institute for Enquiry on Poverty. Special Report no.77

- ^ Loprest, Pamela. 2001. How Are Families that Left Welfare Doing? A Comparison of Early and Contempo Welfare Leavers. Serial B, No B-36, Assessing the New Federalism Project. Washington, D.C.: Urban Institute. April

- ^ "Caseload Data". Administration for Children and Families. Retrieved October 12, 2008.

- ^ "Historical Poverty Tables". U.South. Census Bureau. Archived from the original on April xix, 2008. Retrieved October 12, 2008.

- ^ "Labor Strength Statistics including the National Unemployment Rate". U.S. Section of Labor, Bureau of Labor Statistics. Retrieved November 1, 2008.

- ^ TANF – Caseload Data – U.Due south. Department of Wellness and Human Services, Administration for Children and Families, Office of Family Assistance

- ^ Number Below Poverty Level and Rate – Historical Data – U.S. Census, 2010

- ^ Schoeni, Robert F.; Blank, Rebecca G. (December 2003). "What Has Welfare Reform Achieved? Impacts on Welfare Participation, Employment, Income, Poverty, and Family Structure" (PDF). PSC Research Report. No. 03-544.

- ^ Bitler, Marianne. 2004. "The Touch on of Welfare Reform on Matrimony and Divorce". Demography 41(2):213–236

- ^ Harknett, K. and L.A. Gennetian. 2003. "How An Earning Supplement Can Affect Union Formation Among Depression-Income Single Mothers." Census xl:451-78

- ^ Ellwood, D. T. and C. Jencks. 2001. "The Growing Differences in Family unit Construction: What Do We Know? Where Do Nosotros Expect for Answers?" Unpublished manuscript, John F. Kennedy School of Government, Harvard University, Cambridge, MA.

- ^ Horvath-Rose, A. and HE Peters. 2002. "Welfare waivers and nonmarital fertility". in For Amend and For Worse: Welfare Reform and Well-Being of Children and Families. New York: Russell Sage Foundation, 222–245

- ^ Henshaw, South. Thou. 2001. Birth and abortion data. In Data Needs for Measuring Family and Fertility Change After Welfare Reform, ed. D. J. Basharov. College Park, MD: Welfare Reform University

- ^ Duncan, G. J. and 50. Hunt-Lansdale. 2002. For Meliorate and For Worse: Welfare Reform and the Well-Being of Children and Families. New York: Russell Sage Foundation.

- ^ Mistry, R.S., D.A. Crosby, AC Huston, and DM Casey, Thousand Ripke. 2002. Lessons from New Hope: the impact on children'southward well-existence of a work-based anti-poverty program for parents. See Duncan and Chase-Landsdale 2002

- ^ Bernal, R.; Keane, M. P. (2011). "Child care choices and children's cognitive achievement: The instance of single mothers". Journal of Labor Economic science. 29 (3): 459–512. CiteSeerXx.1.1.378.9391. doi:10.1086/659343. S2CID 10002078.

- ^ Kalili, Ariel et al. 2001. "Does Maternal Employment Mandated by Welfare Reform Touch on Children's Behavior?" In For Improve and for Worse: Welfare Reform and the Well-being of Children Families. New York: Russell Sage Foundation

- ^ Golden, Olivia. 2005. Assessing the New Federalism, 8 Years Later. Urban Establish

- ^ a b Danziger, Due south. K. 2001. Why some neglect to achieve economic security: Depression job skills and mental health problems are key barriers. Forum iv(2):1–3

- ^ Pollack, H.; Danziger, S.; Jayakody, R.; Seefeldt, K. (2002). "Drug Testing Welfare Recipients—False Positives, Simulated Negatives, Unanticipated Opportunities". Women'due south Health Issues. 12 (1): 23–31. doi:10.1016/S1049-3867(01)00139-6. PMID 11786289.

- ^ London, A. S., Scott, Due east. Chiliad., Edin, K. and Hunter, V. (2004), "Welfare Reform, Work-Family Tradeoffs, and Child Well-Being". Family Relations 53: 148–158

- ^ Peterson, Janice; Vocal, Xue; Jones-DeWeever, Avis (May 2002). "Life Afterward Welfare Reform: Low-Income Single Parent Families, Pre- and Post-TANF" (PDF). Found for Women's Policy Inquiry.

- ^ "TANF: Total Number of One Parent Families Fiscal Year 2020" (PDF). U.S. Section of Health & Human Services.

- ^ Zedlewski, Sheila and Olivia Golden. 2010. "Next Steps for Temporary Assistance for Needy Families." The Urban Constitute: Brief(eleven) accessed December 12/2011 from http://world wide web.urban.org/UploadedPDF/412047_next_steps_brief11.pdf

- ^ "Questions and Answers almost the TANF Emergency Fund" (PDF). Center for Law and Social Policy. Retrieved October viii, 2010.

- ^ Cooper, Michael (September 25, 2010). "Job Loss Looms as Role of Stimulus Expires". New York Times . Retrieved October 8, 2010.

- ^ "Walking Away From a Win-Win-Win Subsidized Jobs Slated to End Soon Are Helping Families, Businesses, and Communities Conditions the Recession". Center on Budget and Policy Priorities. September 2010. Retrieved October 8, 2010.

- ^ "Approved State, Territory & DC TANF Emergency Fund Applications by Category". U.South. Department of Health and Human being Services, Administration for Children and Families. Retrieved Oct 8, 2010.

- ^ Eye for Police and Social Policy. 2010. "TANF Reauthorization." Accessed 12/12/2011 from http://www.clasp.org/federal_policy/pages?id=0021

- ^ a b Irving, Shelley Grand. (Dec i, 2008). "State Welfare Rules, TANF Exits, and Geographic Context: Does Identify Affair?*". Rural Sociology. 73 (four): 605–630. doi:10.1526/003601108786471549. ISSN 1549-0831.

- ^ Anderson, Steven Yard. (January 1, 2002). "Ensuring the Stability of Welfare-to-Work Exits: The Importance of Recipient Knowledge most Work Incentives". Social Work. 47 (2): 162–170. doi:x.1093/sw/47.ii.162. JSTOR 23717936. PMID 12019803.

- ^ Anderson, Steven Thousand.; Schuldt, Richard; Halter, Anthony P.; Scott, Jeff (January 1, 2003). "Employment Experiences and Back up Services Employ Following TANF Exits". The Social Policy Journal. 2 (i): 35–56. doi:10.1300/J185v02n01_04. ISSN 1533-2942. S2CID 154639073.

- ^ Acs, Gregory (Baronial 2007). "Helping Women Stay Off Welfare: The Office of Mail service-Exit Receipt of Piece of work Supports". The Urban Institute . Retrieved Nov 16, 2016.

- ^ Ii Clinton Aides Resign to Protestation New Welfare Law by Alison Mitchell, The New York Times, September 12, 1996

- ^ Poverty & Welfare: Does Compassionate Conservatism Accept a Center? Peter B. Edelman 64 Alb. L. Rev. 1076 2000–2001.

- ^ The worst thing Beak Clinton has washed, Peter Edelman, The Atlantic, March 1997

- ^ Every bit Progressives Predicted, Clinton Welfare Reform Law Fails Families by Randy Shaw in BeyondChron (April 19‚ 2010)

External links [edit]

- Welfare Reform and Single Mothers (Yale Economic Review)

- Congressional Research Service Report on TANF

- Government Accountability Office Report on TANF

- The Center for Law and Social Policy

- Numbers On Welfare See Sharp Increase by Sara Murray, The Wall Street Periodical, June 21, 2009

- Welfare's condom cyberspace difficult to mensurate among states by Amy Goldstein, "The Washington Mail service", October 2, 2010

- "Function of Family unit Assistance (OFA)"

Source: https://en.wikipedia.org/wiki/Temporary_Assistance_for_Needy_Families

Post a Comment for "What Kind of Grant Is Temporary Assistance for Needy Families"